Let's face it: life can get expensive. Whether you're dealing with rising costs of living, unexpected expenses, or just trying to stretch your paycheck further, saving money when you're struggling to make ends meet can feel like an impossible task. But here's the good news—it's not. With the right strategies, a little discipline, and a willingness to make some changes, you can take control of your finances and start building a better financial future.

In this article, We'll take you through practical steps to save money, even when it feels like there's nothing left to cut. Let's dive in.

Build Financial Discipline

Saving money starts with a mindset. If you're constantly living paycheck to paycheck, it's easy to feel like you're stuck in a cycle. But the truth is, small changes in your habits can lead to big results over time.

I remember a time early in my career when I was juggling multiple projects and barely making enough to cover my bills. I realized that I was spending money on things I didn't really need. It wasn't until I took a hard look at my spending habits that I started to see where I could cut back.

Financial discipline isn't about depriving yourself; it's about making intentional choices. Start by tracking your spending for a month. You might be surprised at where your money is going.

Create a Budget

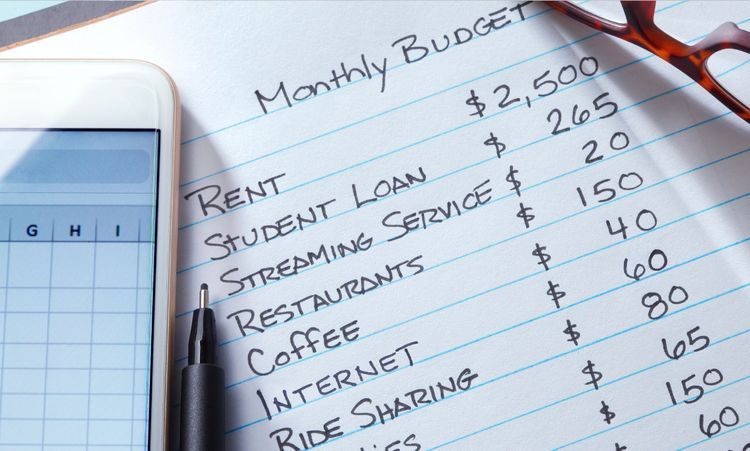

One of the most effective ways to save money is by creating a budget. A budget gives you a clear picture of your income and expenses, helping you identify areas where you can cut back.

What is the 50/30/20 Rule of Money?

If you're new to budgeting, the 50/30/20 rule is a great place to start. Here's how it works:

- 50% of your income goes toward needs (rent, utilities, groceries, etc.).

- 30% of your income goes toward wants (entertainment, dining out, etc.).

- 20% of your income goes toward savings and debt repayment.

This rule isn't set in stone—you can adjust the percentages based on your financial situation. For example, if you're struggling to make ends meet, you might need to allocate more toward needs and less toward wants.

Reduce Debt

Debt can feel like a heavy weight, especially when you're trying to save money. High-interest debt, like credit card balances, can eat into your income and make it harder to get ahead.

Start by listing all your debts, including the balances and interest rates. Focus on paying off high-interest debt first, as it costs you the most over time. Consider strategies like the debt snowball method (paying off the smallest debts first) or the debt avalanche method (tackling the highest-interest debts first).

Prepare an Emergency Fund

An emergency fund is your financial safety net. It's there to cover unexpected expenses, like car repairs or medical bills, so you don't have to rely on credit cards or loans.

Aim to save at least three to six months' worth of living expenses. If that sounds daunting, start small. Even $500 can make a big difference in an emergency.

Increase Income

Sometimes, cutting expenses isn't enough. If you're struggling to make ends meet, finding ways to increase your income can help bridge the gap.

Consider taking on a side hustle, freelancing, or selling items you no longer need. Platforms like Uber, Fiverr, and eBay make it easier than ever to earn extra cash.

A few years ago, I started freelancing on the side to supplement my income. It wasn't always easy balancing a full-time job and freelance work, but the extra money helped me pay off debt and build my savings.

Seek Assistance

There's no shame in asking for help when you need it. If you’re struggling to make ends meet, look into government assistance programs, nonprofit organizations, or community resources that can provide support.

For example, programs like SNAP (Supplemental Nutrition Assistance Program) can help with groceries, while local charities may offer assistance with rent or utilities.

Cut Back on Expenses

Of course, one of the most effective ways to save money is to trim your expenses. Start by looking at your biggest budget categories - usually housing, transportation, and food.

Could you downsize to a smaller apartment or take on a roommate? Trade in your car for a more fuel-efficient model (or even go car-free if your city has good public transit) .Meal prep at home instead of grabbing takeout?

Small luxuries can also add up over time. Think about ditching that pricey cable package for a cheaper streaming service, or make your coffee at home instead of hitting the drive-thru every morning. It may take some trial and error to find the right balance, but every little bit helps!:

Conclusion

Saving money when you're struggling to make ends meet isn't easy, but it's possible. By taking small, intentional steps, you can start to build a better financial future.

Remember, it's not about perfection—it's about progress. Whether it's creating a budget, reducing debt, or finding ways to increase your income, every step you take brings you closer to financial stability.