Sometimes life throws you a curveball, and one of those curveballs could be an accident that leaves your car “totaled but still drivable.” But what does that even mean? Can you still legally drive it? What should you do next? In this guide, we’ll dive deep into everything you need to know about what happens when your car is totaled but still drivable.

What Does It Mean for a Car to Be “Totaled”?

“Totaled” doesn’t mean your car has turned into a hunk of metal on the side of the road. It’s all about the economics. When your insurance company says your car is “totaled,” it means the cost to repair the vehicle is more than the car’s actual cash value. Essentially, the insurance provider doesn’t want to invest in a car that’s worth less than the cost of fixing it.

How is a Car Declared Totaled?

- Repair Costs vs. Cash Value: If repair costs are 70-80% of your car’s market value, many insurance companies will declare it totaled. This threshold can vary depending on the insurance company and state regulations.

- Fair Market Value: The fair market value is what your car is worth at the time of the accident. If the estimated cost of repairs exceeds this value, it’s considered a total loss.

- Insurance Adjusters: Insurance adjusters assess the vehicle damage and determine whether it’s a loss or if it can be repaired within a reasonable cost.

Common Factors Insurance Companies Consider

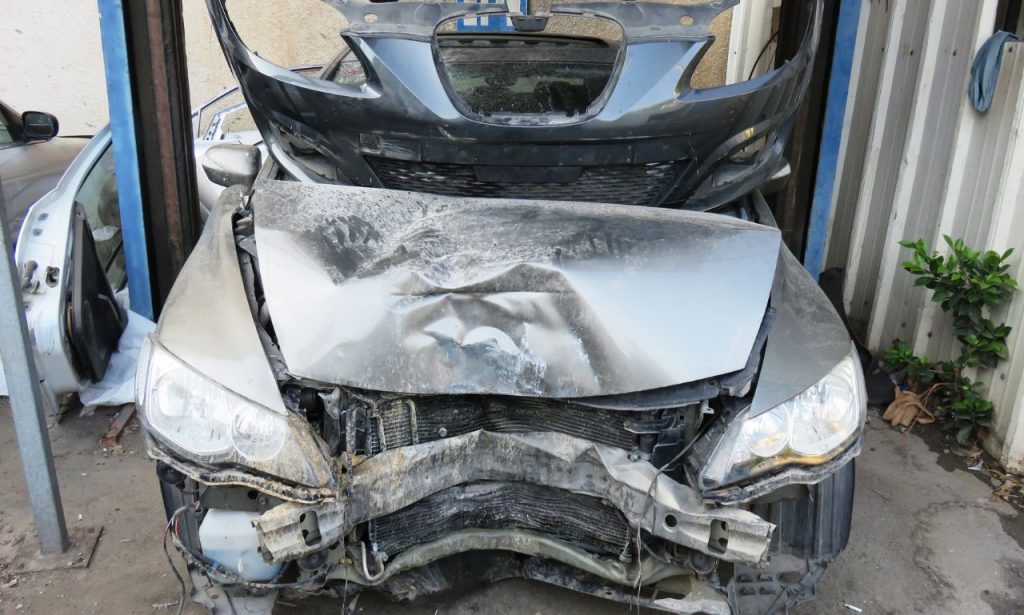

- Structural Damage: If the frame is bent beyond safe repair, it’s totaled. A car’s frame is critical to its overall safety, and any compromise can be dangerous.

- Comprehensive Coverage: Comprehensive coverage includes damages caused by natural disasters, vandalism, or theft. If the damages are too costly to fix, the vehicle may be declared a total loss.

- Collision Coverage: Collision coverage is key when a car is severely damaged in an accident. If the damages exceed the actual cash value, the car will be totaled.

Why Would a Drivable Car Be Declared Totaled?

Now, this is where things get interesting. What happens when your car is totaled but still drivable? Well, there’s a good reason behind it.

High Repair Costs

Your car may still run, but if fixing all the dents, scratches, and replacing damaged parts costs more than the car’s value, it’s declared totaled. Even if it drives like a dream, it’s still seen as a loss by the insurance company. Repair costs can add up quickly, especially when there are multiple issues to address, and sometimes it’s just not worth it from an economic perspective.

Safety Standards

Sometimes, a car may be drivable but unsafe. The structural integrity could be compromised, and while you might be able to drive it, the insurance company doesn’t want the liability of a potential breakdown or, worse, another accident. Safety is a primary concern, and driving a car that has been compromised in a crash may lead to severe consequences in the event of another collision.

Understanding Your Insurance Company’s Assessment

Insurance assessments might feel like they’re spoken in a different language. Let’s break it down.

Insurance Adjusters’ Role

- Claims Adjuster: They assess the damage and decide if it’s worth fixing. Their job is to evaluate the repair costs against the car’s actual cash value to determine if it should be declared totaled.

- Repair Estimates: Adjusters gather repair estimates from auto repair shops to see if the cost exceeds the car’s market value.

- Insurance Challenges: Sometimes, insurance companies make lowball settlements—stand your ground! If you feel the payout doesn’t reflect your car’s value, don’t hesitate to challenge it.

Your Role in the Process

- Provide Evidence: Pictures of the car pre-accident and any receipts for recent repairs or upgrades can be helpful. Documentation can make a big difference in proving your car’s value.

- Get a Second Opinion: It’s always smart to consult a trusted mechanic to ensure the insurance assessment is fair. Having an independent assessment can help you negotiate with the insurance company if needed.

Options After Your Car is Declared Totaled

A totaled car doesn’t mean you’re out of options. In fact, you’ve got quite a few.

Accepting the Insurance Payout

- Insurance Settlement: This is often the simplest route. You take the payout, which is the car’s actual cash value minus any deductibles.

- Loan Balance: If you still owe on a car loan, the payout will first cover what’s owed to your finance company. If the payout doesn’t cover the entire loan balance, you’ll still be responsible for the difference.

- Gap Insurance: If your loan balance is more than the payout, gap insurance can cover the difference. Gap insurance is particularly useful when you’re upside-down on your loan (owing more than the car’s worth).

Keeping the Vehicle

Want to hold onto your beloved ride? You can.

- Buyback Process: Often called a “buyback,” you can keep the totaled car by buying it back from the insurance company. The insurance company will deduct the salvage value from your payout.

- Salvage Title: Keeping the car means it will be given a salvage title, indicating it’s been in an accident. A salvage title can make the car more difficult to insure and sell, but it may still be worth it if the car is in drivable condition.

Selling for Parts

- Salvage Yards: Selling the vehicle to salvage yards can be profitable, especially if there are usable parts that are still in good condition.

- Parting It Out: You could sell individual parts yourself—potentially making more than you would from a salvage yard. Parts like engines, transmissions, and even electronics can be quite valuable.

Legal Considerations for Driving a Totaled Car

Salvage Title and Legal Restrictions

If you’re keeping a car after it’s declared totaled, it’ll come with a salvage title. Driving a salvage title vehicle can come with specific legal requirements.

- Safety Inspections: Many states require a safety inspection before a salvage title car can be driven again. These inspections are meant to ensure the car is roadworthy and meets safety standards.

- Insurance Issues: Finding insurance for salvage title vehicles can be tricky, but it’s not impossible. Some insurance companies will only offer liability coverage, while others may refuse to insure the car altogether.

Legal Advice

- Accident Lawyer: Consulting an accident lawyer can provide insight into your rights and responsibilities. An experienced attorney can help navigate any legal hurdles you may face.

- Implications for Insurance Coverage: Driving a totaled car might affect your future insurance coverage, as insurance providers may view it as a higher risk.

Safety Implications of Driving a Totaled Car

Concerns About Safety

Just because your car still drives doesn’t mean it’s safe.

- Structural Integrity: The frame might be compromised, which makes it less protective in another accident. A compromised frame can lead to catastrophic failure in a crash.

- Airbags and Special Features: Damaged safety features may no longer work properly. If airbags have deployed, they must be replaced, which can be a costly repair.

Consumer Safety Measures

- Adequate Repairs: Ensuring the car is adequately repaired is crucial if you decide to drive it. Skimping on repairs can have serious safety implications for you and others on the road.

- Considerations to Safety: Always weigh the safety concerns before deciding to drive a totaled car. Consider whether the cost of repairs will truly make the car safe again.

Obtaining Insurance on a Totaled Car

Insurance Challenges with Salvage Title Vehicles

Getting insurance on a totaled car is tough, but not impossible.

- Salvage Title Insurance: Some insurance companies provide limited coverage for salvage title cars. It’s often limited to liability coverage, as the risk associated with comprehensive or collision coverage is higher.

- Liability Coverage: Typically, only liability coverage is offered for salvage vehicles, as collision and comprehensive coverage may be unavailable. Liability coverage is the minimum required by law in most states.

Reliable Insurance Quotes

- Shop Around: Different insurance carriers have different rules when it comes to insuring salvage vehicles. Get multiple quotes to find the best option.

- Implications for Insurance Rates: Expect higher insurance rates due to the increased risk. Salvage title cars are considered more likely to be involved in future claims, leading to higher premiums.

The Process of Securing a Salvage Title

Steps to Follow

- Department of Motor Vehicle (DMV): You’ll need to visit the DMV to apply for a salvage title. The DMV will issue the salvage title after certain criteria are met, such as proof of ownership and a detailed inspection.

- Safety Inspections: A thorough safety inspection is often required before the salvage title is granted. The inspection ensures that the vehicle is roadworthy and that all repairs have been made to meet safety standards.

Legal Decisions

- Rebuilt Title: If you repair the car, you may be eligible for a rebuilt title, making it easier to insure. A rebuilt title indicates that the car has been repaired and is considered safe to drive again.

- Accident Lawyer: Consult legal advice to understand the implications of driving with a salvage title. An accident attorney can help you navigate the complexities of owning a salvage title vehicle.

Negotiating with Your Insurance Provider

Getting Fair Compensation

Insurance companies may try to give you less than you deserve. It’s up to you to fight for fair compensation.

- Appraisal Provision: Use an appraisal provision if you and the insurance company can’t agree. This provision allows you to hire an independent appraiser to evaluate the car’s value.

- Hire an Experienced Attorney: A skilled attorney can help you negotiate better terms. If you feel that the insurance company is not providing fair compensation, an attorney can represent your interests.

Lowball Settlements

- Avoid Accepting the First Offer: Insurance companies often start with a low offer. Negotiate until you get what’s fair. Be persistent and provide evidence of your car’s value to justify a higher payout.

- Objective Third-Party Resource: Use online resources to determine your car’s market price and ensure you’re getting a decent replacement value. Websites like Kelley Blue Book or Edmunds can be helpful in assessing the value.

The Role of Gap Insurance

Gap insurance can be a lifesaver if your car is totaled but you still owe more than its value.

Loan Balance Coverage

- Covers the Gap: Gap insurance covers the “gap” between what your car is worth and what you owe on it. This can prevent you from having to pay out-of-pocket for a car you can no longer use.

- Finance Company Requirement: Some finance companies require gap insurance when you finance a vehicle, especially if you make a small down payment and the car’s value depreciates quickly.

Future Insurance Coverage

- Worth Considering: Gap insurance is worth considering, especially if you’re upside-down on a loan. It’s an additional expense but can save you thousands in the event of a total loss.

Evaluating the Financial Impact of a Totaled Car

Cost of Repair vs. Replacement

- Repair Costs: Repair costs can quickly add up, making it financially impractical to repair a totaled vehicle. Even if the car is drivable, the cumulative costs can outweigh its value.

- Replacement Cost: Sometimes, it’s cheaper to buy a new car than to repair a totaled one. Consider the long-term value and reliability when making this decision.

Financial Burden

- Loan Balance: If you’re still paying off the car, the insurance payout may not cover what you owe. This is where gap insurance comes in handy.

- Additional Loans: You might need an additional loan to cover the cost of a replacement vehicle. Make sure you evaluate your financial situation before taking on additional debt.

Is It Worth Repairing a Totaled Car?

Assessing Damage and Costs

- Repair Estimates: Get multiple repair estimates to determine if it’s worth fixing the car. Compare these estimates to the car’s value and the potential resale value after repairs.

- Auto Repair Bills: Be prepared for potentially high auto repair bills, especially if structural damage is involved. Repairs may also take longer than anticipated, adding to the inconvenience.

Car’s Post-Repair Safety

- Safety Standards: Ensure all repairs meet safety standards to protect you and others on the road. Even minor damages can have serious safety implications if not properly fixed.

- Considerations to Safety: Even after repairs, a totaled car may not be as safe as it once was. Always consider whether the repaired car will truly meet your expectations in terms of safety and reliability.

Conclusion

When dealing with a totaled car that’s still drivable, you’re faced with a lot of choices—some tougher than others. Whether you accept an insurance payout, keep the car, or decide to sell it for parts, understanding your options helps you make the best decision for your situation. Remember, safety should always be your top priority. And if you’re keeping that car, make sure you have the right coverage to keep you protected. Knowing what happens when your car is totaled but still drivable can empower you to make informed decisions that are best for your safety and finances.

ALSO READ: How to Keep Your Dodge Challenger from Being Stolen

FAQs

Yes, but it usually requires passing a safety inspection first, depending on your state.

Structural integrity and compromised safety features can make it dangerous.

Provide evidence, get multiple repair estimates, and consider hiring an attorney if needed.

It’s possible, but typically you can only get liability coverage, and rates may be higher.